Getting do-end up being homebuyers looking to purchase a home with little to no currency down the Texas USDA financing is actually a great wise decision. There have been two variety of USDA mortgage brokers. You’ve got the Guaranteed USDA Loan and also the Head USDA loan. The Head USDA loan is when a borrower performs actually with the brand new USDA. USDA funds inside the Texas try facilitated most often from the personal lenders and you can backed by the united states Agencies out of Agriculture. By the meaning, this new Colorado USDA mortgage is actually for reduced so you can modest-earnings earners into the outlying areas. For the Colorado, an excellent USDA mortgage now offers several great features so you’re able to qualified consumers or someone trying to refinance. Some of those is:

- 100% funding

- Reduced financial insurance coverage (Be sure Payment)

- No criteria having quick assets

- Buyer can get a gift to possess closing costs

- Self-reliance which have credit

This new USDA loan even offers extremely aggressive costs the same as FHA. New settlement costs and you can cost vary certain from lender so you can financial how aggressive landscaping of financial credit provides most loan providers comparable in this regard. Not totally all loan providers provide the USDA mortgage making it crucial that you query towards the front end.

USDA mortgages keeps several advantages toward consumers that utilize them. As mentioned before the quintessential glamorous benefit ‘s the a hundred% no money down ability. The actual only real almost every other mortgage style of which provides this is the Virtual assistant financial but visit this page it only for veterans. This feature by yourself can save a house consumer thousands of dollars inside the out-of-pocket can cost you. Although this is the absolute most preferred ability in order to Tx domestic customers that isn’t really the only high ability. Other things that everyone loves towards USDA financing try:

- Aggressive interest levels.

- 30-seasons terms

- All the way down home loan insurance (Be certain that Fee)

- 100% investment

Precisely what does USDA money restrictions imply?

The fresh new USDA mortgage during the Texas and all other parts of the world features income limits. This is the simply financing type who may have this limitation. Due to the fact financing is perfect for reduced so you can moderate-money properties the usa Company away from Farming limitations the quantity of income according to the average earnings to your area. They normally use a factor out-of 115% of your median earnings for the area. An example of this could be should your median family income to possess an area try $75,000 + $eleven,250 (15% away from $75,000) the most house earnings might possibly be $86,250. The item Colorado homeowners must remember about this is the keyword domestic. It means all working some body along aside from who’s otherwise who’s not on the loan. How to influence the maximum domestic money to have a great provided city is to apply the new USDA web site and you can which lists by state and you may county brand new constraints. You to definitely main point here to remember is the fact no matter if people inside your house receives taxation-exempt income it will still be sensed in the total domestic earnings.

The fresh Texas USDA financing does not have an optimum amount borrowed however, there are many more secrets to consider when that have it conversation. As previously mentioned prior to there is certainly an optimum toward deductible house money one in addition to the maximum loans ratios keeps the newest USDA loan from the a certain top. Including, an earnings price of $500,one hundred thousand perform technically getting enjoy but with a max domestic earnings out of $ninety,100000 will be hard-pushed to help with your debt within thresholds that are put forward.

Can i refinance my personal house with an excellent USDA Financial?

The USDA loan really does support refinances but there’s a great catch. Home owners which actually have a great USDA financial normally refinance having another type of USDA mortgage however they have to have been in its latest USDA financing to own at least at least 1 year. They are able to create a basic refinance or a streamline refinance. This new improve has actually shorter paperwork compared to the standard. If a citizen possess home financing that is not good USDA mortgage, they can’t refinance toward good USDA home loan. Including, if an individual removes a property financing with regards to local bank to build an alternate house, they will generally speaking should re-finance into a more permanent mortgage nonetheless never refinance with the good USDA loan once the totally new mortgage is a housing loan.

Must i set currency down on a USDA loan?

Sure, borrowers can place money down on an effective USDA financing. Due to the fact USDA financial is recognized for brand new 100% no money down function Tx homeowners normally and you can would lay money down while using this financing tool. Why a borrower carry out lay currency down is that it you can expect to afford them much more house for this reason reducing its commission. They’re able to do this nonetheless make use of every most other bells and whistles associated with the loan device particularly lower mortgage insurance policies, versatile credit, and you can six% seller paid off closing costs.

Really does new Colorado USDA mortgage keeps a max amount of acreage enjoy?

No, there’s not always an optimum number of acreage desired. The issue comes up in the event that house in itself exceeds 31% of full property value the transaction. When this occurs they while the a reduced amount of a home loan and you can more of a secure financing and even though discover property loan software readily available brand new USDA unmarried-family relations construction loan try directed at single-loved ones homes.

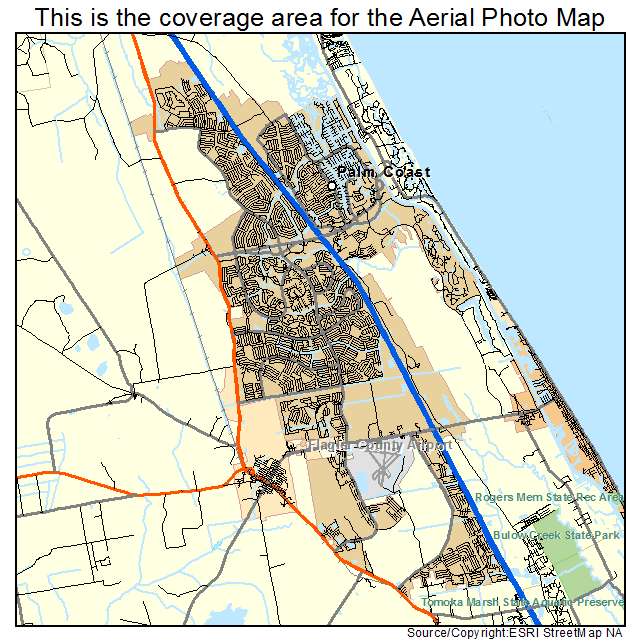

What is a qualifying city?

The fresh USDA home loan is made for those who are to purchase or refinancing with what is a being qualified town. This on occasion should be misleading because individuals disturb the phrase rural once the remote that’s defiantly not the case. Being qualified section is components considered become eligible considering society. Its more often than not just outside of big urban centers. A corner of your own U.S. in reality qualifies with the USDA financing hence applies to Texas as well. Everything 98% of the nation qualifies. Discover an excellent stigma that a house consumer must pick in a really outlying area that’s needless to say false.

View Authoritative USDA Loan Criteria

Specific products may not be for sale in the states. Borrowing from the bank and equity was subject to recognition. Small print apply. That isn’t a commitment so you’re able to give. Apps, pricing, terms and conditions are at the mercy of change with no warning.

PRMI NMLS 3094. PRMI try the same Housing Lender. It is not a connection in order to provide. Borrowing from the bank and you will collateral are subject to acceptance. Conditions and terms apply. Programs, rates, conditions, and you may conditions are susceptible to changes and tend to be subject to debtor(s) degree.